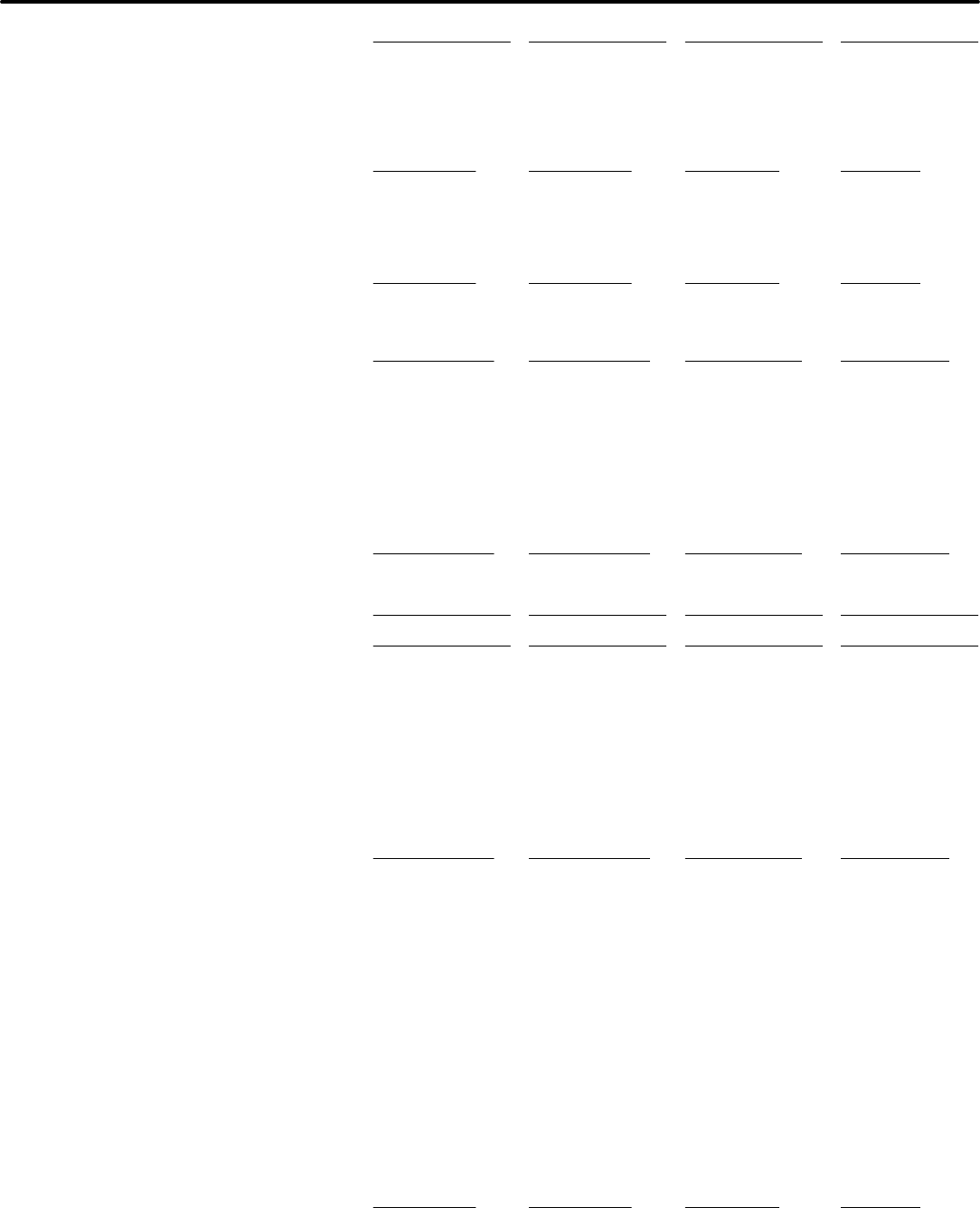

Sample Organization

Statement of Financial Income and Expense

Accrual Basis

January through December 2018

Jan - Dec 18 Budget $ Over Budget % of Budget

Income

40000 · Raised Income

40500 · Individual Contributions 205,182.50 169,775.76 35,406.74 120.9%

41000 · Corporate Contributions

41100 · Corporate Grants 248,131.70 173,360.34 74,771.36 143.1%

41200 · Corporate Sponsorships 22,839.88 17,739.88 5,100.00 128.7%

41300 · Corporate Match 7,192.25 5,837.27 1,354.98 123.2%

Total 41000 · Corporate Contributions 278,163.83 196,937.49 81,226.34 141.2%

42000 · Foundation Contributions 129,500.00 121,000.00 8,500.00 107.0%

43000 · Government Contracts

43100 · Local Contracts 191,850.00 213,869.86 -22,019.86 89.7%

43300 · Federal Contracts 221,499.77 249,970.81 -28,471.04 88.6%

Total 43000 · Government Contracts 413,349.77 463,840.67 -50,490.90 89.1%

44000 · Community Groups 92,444.10 89,450.00 2,994.10 103.3%

45000 · In-Kind Income 50.00 25.00 25.00 200.0%

Total 40000 · Raised Income 1,118,690.20 1,041,028.92 77,661.28 107.5%

47000 · Earned Income

47100 · Interest on Loans 10,161.62 9,779.02 382.60 103.9%

47200 · Fee for Service Income 10,615.00 11,750.00 -1,135.00 90.3%

47300 · Program Fees 26,798.80 24,669.12 2,129.68 108.6%

47500 · Retail Sales 300,579.29 300,445.15 134.14 100.0%

48000 · Interest Income 3,177.64 1,902.43 1,275.21 167.0%

48500 · Gain/(Loss) on Investment 3,554.44 2,139.56 1,414.88 166.1%

49000 · Other Income 7,707.56 2,805.86 4,901.70 274.7%

Total 47000 · Earned Income 362,594.35 353,491.14 9,103.21 102.6%

49900 · Temporarily Restricted Revenue 247,917.00 247,917.00 0.00 100.0%

Total Income 1,729,201.55 1,642,437.06 86,764.49 105.3%

Gross Profit 1,729,201.55 1,642,437.06 86,764.49 105.3%

Expense

60000 · Direct Expenses

60100 · Classroom Space 8,508.02 9,378.02 -870.00 90.7%

60200 · Client Incentives

9,662.41 7,771.81 1,890.60 124.3%

60250 · Credit Pulls 458.78 369.18 89.60 124.3%

60500 · Program Supplies 12,226.91 15,459.41 -3,232.50 79.1%

60600 · Program Travel 9,317.14 5,879.01 3,438.13 158.5%

60800 · Retail Consignment 151,953.63 150,919.92 1,033.71 100.7%

60900 · Retail Damage/Theft 1,660.45 2,327.33 -666.88 71.3%

60950 · Retail Shipping 126.70 357.70 -231.00 35.4%

Total 60000 · Direct Expenses 193,914.04 192,462.38 1,451.66 100.8%

70000 · Indirect Expenses

70050 · Advertising 4,043.56 5,039.16 -995.60 80.2%

70100 · Audit 19,891.25 17,307.50 2,583.75 114.9%

70200 · Business Licenses & Permits 228.75 240.00 -11.25 95.3%

70340 · CC Processing Fees 7,671.22 12,285.19 -4,613.97 62.4%

70400 · Contribution to LRF 10,161.62 9,779.02 382.60 103.9%

70600 · Equipment Purchases 8,216.86 7,418.12 798.74 110.8%

70900 · Finance Charges & Interest 3,628.71 5,244.96 -1,616.25 69.2%

70950 · Fundraising Events 13,124.32 17,076.81 -3,952.49 76.9%

71000 · Insurance 7,188.81 9,966.26 -2,777.45 72.1%

71200 · Networking Expense 17,548.84 16,918.71 630.13 103.7%

71300 · Office Expense 7,526.66 6,888.84 637.82 109.3%

71400 · Postage & Packing 1,129.90 524.70 605.20 215.3%

71500 · Printing and Copying 7,674.21 8,049.83 -375.62 95.3%

72000 · Rent

72100 · Rent - Office 39,094.65 38,805.03 289.62 100.7%

72200 · Rent - Other 3,444.00 3,504.00 -60.00 98.3%

72400 · Rent - Incubator 47,759.21 52,062.82 -4,303.61 91.7%

Total 72000 · Rent 90,297.86 94,371.85 -4,073.99 95.7%

Page 1

01/17/19

11:53 AM

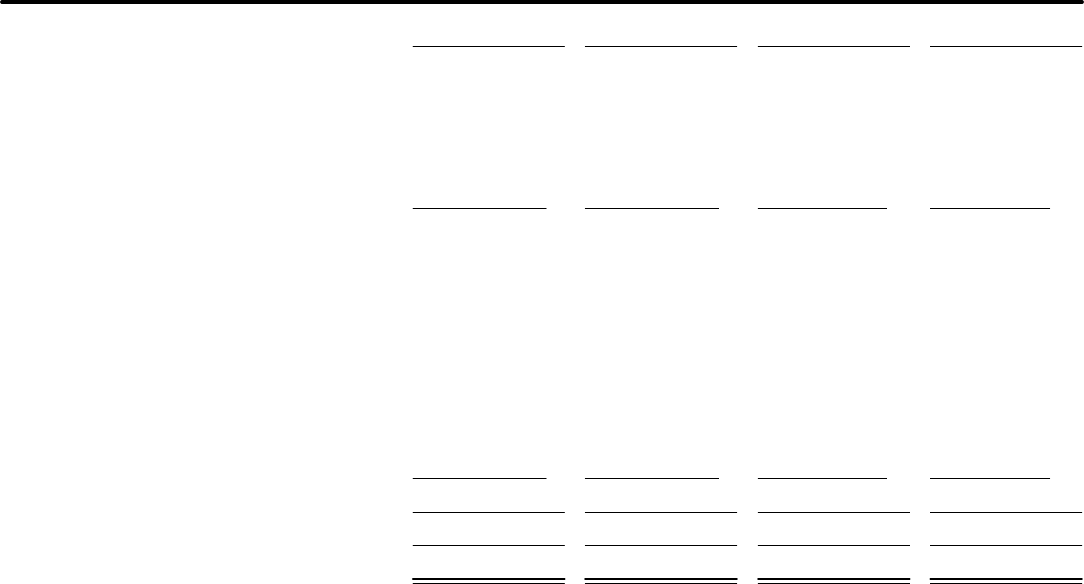

Sample Organization

Statement of Financial Income and Expense

Accrual Basis

January through December 2018

Jan - Dec 18 Budget $ Over Budget % of Budget

73000 · Repairs & Maintenance 1,095.30 823.41 271.89 133.0%

74100 · Software 16,438.70 16,337.81 100.89 100.6%

74200 · State & City Taxes 4,028.39 3,300.84 727.55 122.0%

74500 · Utilities 19,989.13 20,065.35 -76.22 99.6%

75000 · Depreciation 3,690.37

75100 · Bad Debt 3,143.08 3,143.08 0.00 100.0%

75500 · Miscellaneous Expense 100.00 0.00 100.00 100.0%

75900 · Grant Expense 7,130.00 14,260.00 -7,130.00 50.0%

Total 70000 · Indirect Expenses 253,947.54 269,041.44 -15,093.90 94.4%

76000 · Personnel Expenses

76010 · Contractors 35,745.67 41,277.29 -5,531.62 86.6%

76020 · Employee Benefits 102,064.50 115,241.29 -13,176.79 88.6%

76030 · Payroll Processing Fees 1,090.66 1,412.40 -321.74 77.2%

76040 · Payroll Taxes 102,829.18 112,602.67 -9,773.49 91.3%

76050 · Professional Fees 63,623.36 63,976.23 -352.87 99.4%

76070 · Salaries & Wages 987,744.45 998,141.02 -10,396.57 99.0%

76080 · Team Appreciation 10,727.77 11,487.00 -759.23 93.4%

76085 · Team Development 9,291.91 14,164.12 -4,872.21 65.6%

76090 · Team Recruitment 878.59 1,118.13 -239.54 78.6%

76100 · Payroll Expenses 94.41

Total 76000 · Personnel Expenses 1,314,090.50 1,359,420.15 -45,329.65 96.7%

Total Expense 1,761,952.08 1,820,923.97 -58,971.89 96.8%

Net Income -32,750.53 -178,486.91 145,736.38 18.3%

Page 2